|

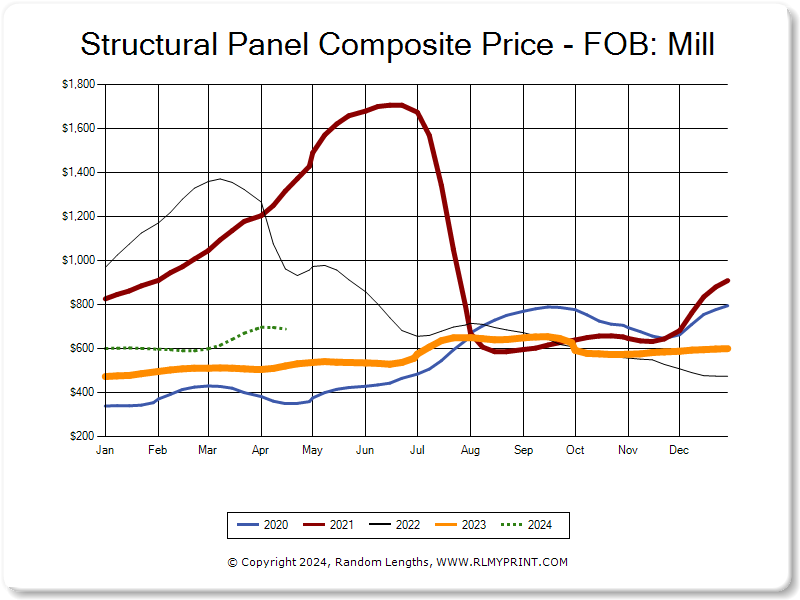

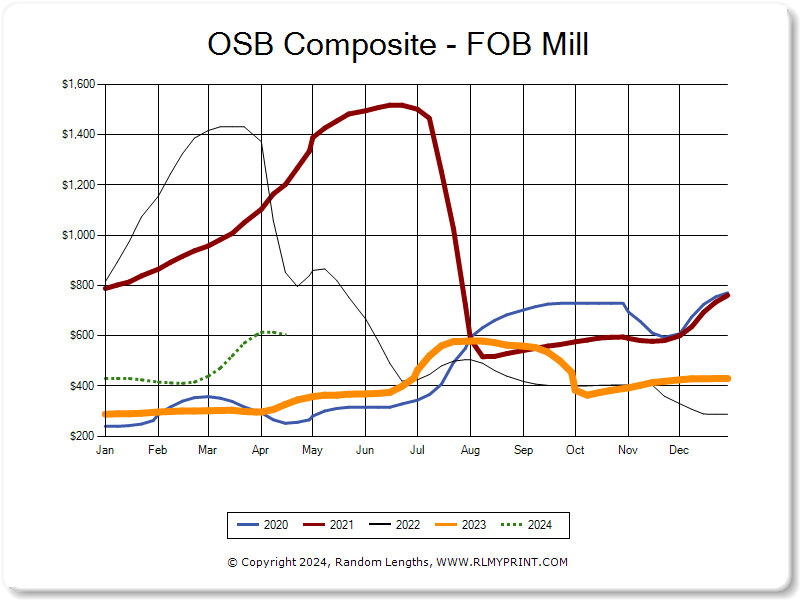

Imagine a crowded dance floor. In the spotlight, there’s one dancer (OSB) stealing the show. Everyone’s watching, impressed by their moves (rapid price increase). That’s been OSB in the lumber market over the last month.

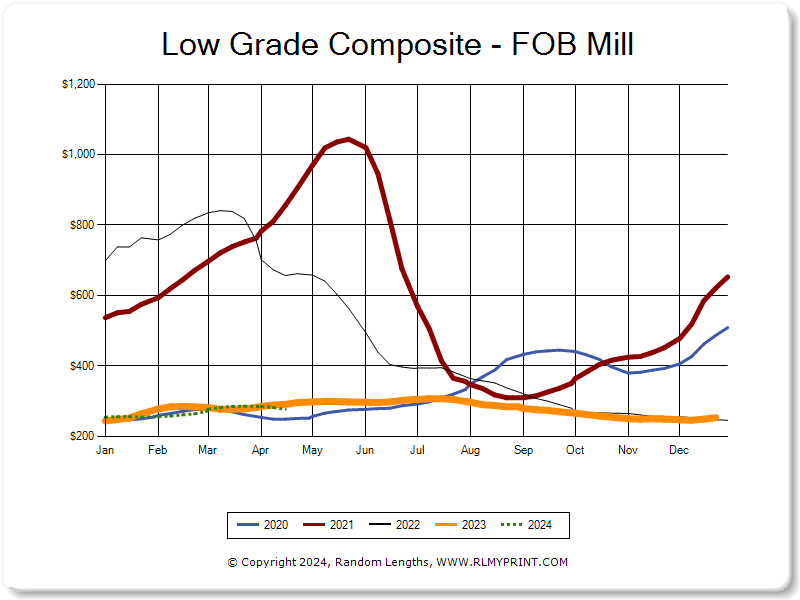

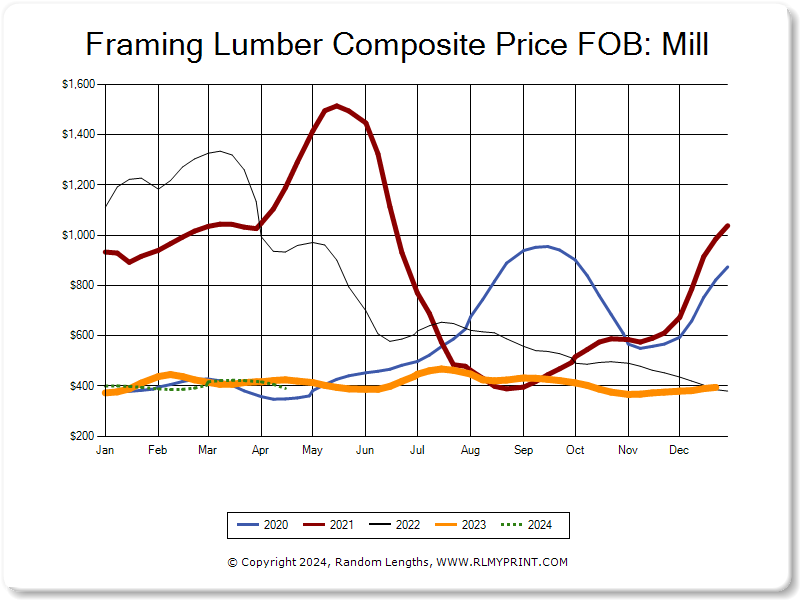

Meanwhile, other lumber products (plywood, dimensional lumber, low grade) are like the bystanders on the dance floor. They’re still around (available), but not getting the same attention (pricing has been relatively steady).

All good dance moves must come to an end when the music subsides. OSB is still on the dancefloor, just not in the spotlight as prices have started to quietly level off (let the slow dances begin).

The Lumber Market Serves as an Economic Indicator

There’s an eerie quiet in the lumber market today mostly driven by uncertainty of the changing economic conditions, and related to new home permits and starts. Single-family home construction in the U.S. saw a significant decline in March.

- Despite the ongoing shortage of existing homes for sale, new construction is being hindered by rising mortgage rates, leading potential buyers to the dancefloor sidelines.

- Reducing new homes sales only fuels the fire for more buyer affordability issues.

- Some multi-family projects are just not penciling out. Multi-family is down significantly over last year, approximately 44 percent.

What does this mean for those needing lumber?

Our team feels like we are in good position to buy lumber right now. While the rest of the nation struggles with weather conditions delaying projects, changing economic conditions, and policy disruptions, Arizona is positioned well with new growth and opportunity.

Trio’s phones are ringing, our trucks are rolling fully loaded out of the lumberyard, our customers are calling consistently with lumber orders.

Right now, our lumber traders are positioned well to negotiate on your behalf and deliver confident quotes to you for your lumber purchases.

|