Flag on the Play: Analyzing the Lumber Market’s Holding Pattern

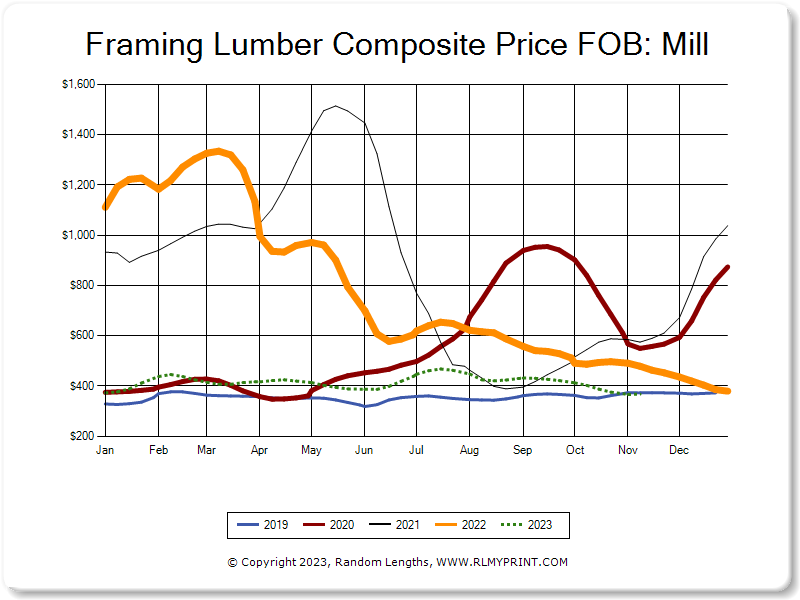

In the intricate game of the lumber market, the referee’s whistle blows, signaling a call that resonates across the field – “HOLDING.” The week unfolds with minimal market activity, and the penalty is palpable – a substantial $10 per thousand board feet across the scoreboard for those who remained on the sidelines, choosing not to make a move. In a market where every decision carries weight, this week’s lumber market holding pattern has consequences.

To counter the stagnation, mills have executed a strategic maneuver comparable to leaving part of their teams in the locker room. This tactic, known as curtailments, takes center stage as Canfor makes headlines by announcing their decision to bench 140,000,000 board feet over the next six months. This move introduces a layer of complexity, influencing both the supply chain and pricing dynamics.

As industry players assemble their Purchasing Playbook for the next quarter, the decision-making process mirrors a football strategy. There’s the option of a conservative play, akin to a field goal – securing guaranteed points by purchasing lumber now for upcoming projects. On the other hand, a more aggressive move involves going for it on fourth down, risking a delay in purchasing to see if prices drop, potentially scoring more points.

However, a word of caution hangs in the air – the risk of scoring nothing and turning the ball over. Navigating this market scenario demands a meticulous evaluation of the playbook and a profound understanding of the ever-shifting dynamics at play.

This holding pattern prompts a deeper reflection on the current state of the lumber market, emphasizing the critical importance of strategic decision-making. For a more comprehensive understanding of market dynamics and insights into crafting a resilient Purchasing Playbook, explore Trio Forest’s Market Insights at this link.

As we dissect the play-by-play, it becomes evident that the lumber market is entrenched in a holding pattern, necessitating strategic moves and meticulous considerations to navigate the field successfully. In this ever-evolving game, staying ahead requires a keen eye, a strategic playbook, and the ability to adapt to the changing dynamics of the lumber market.

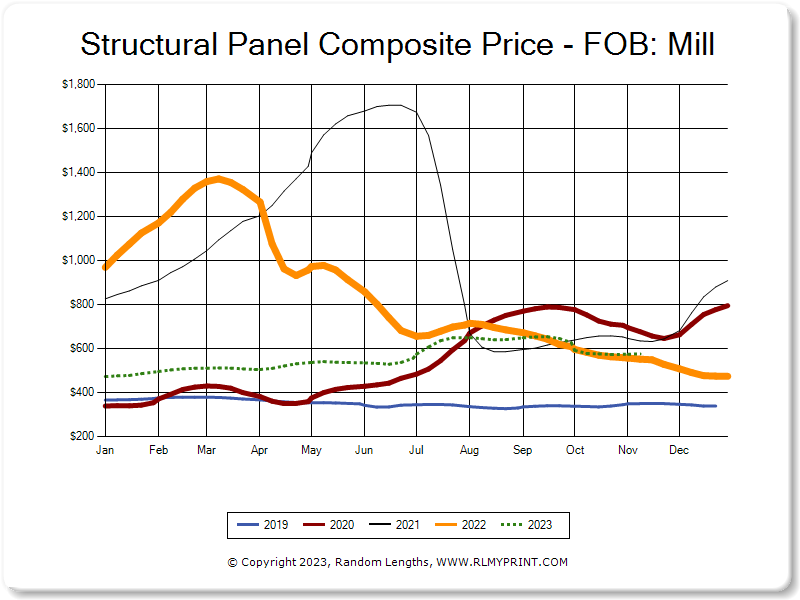

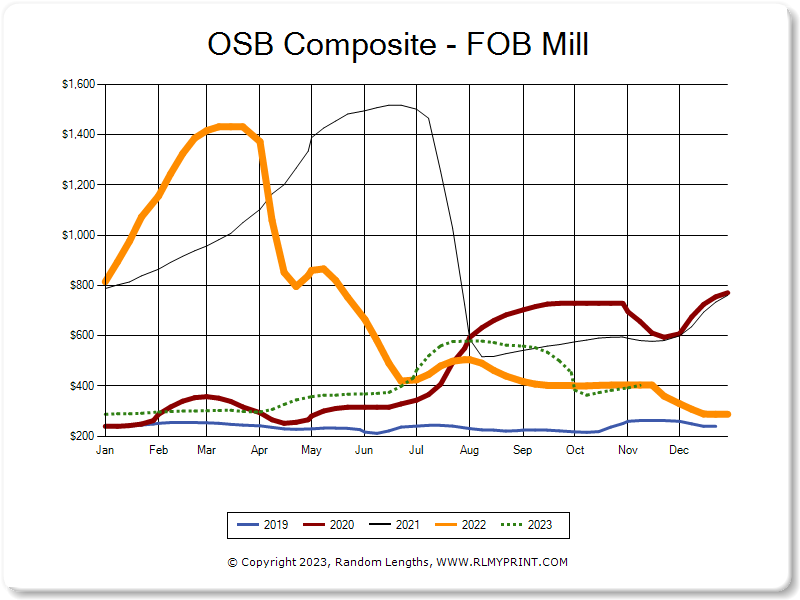

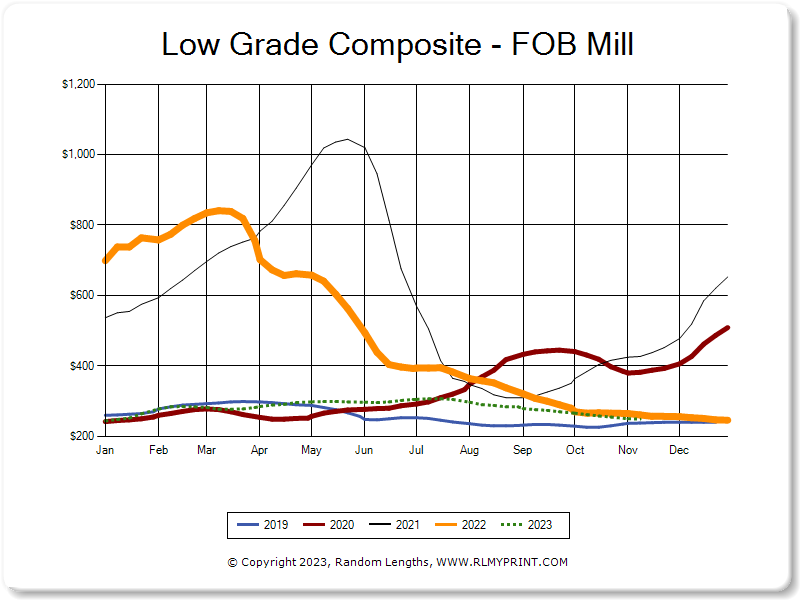

Source: Random Lengths, used here with permission granted by the publisher.