Fourth Quarter Industry Update

We are delighted to share with you our latest insights and developments in the lumber industry for the fourth quarter. Outlined below is a comprehensive industry update, provided with the help of our valued business partner, LMC. We believe it will be a valuable asset for your lumber purchasing decisions and business development discussions. As we reflect on the past quarters and gear up for new opportunities, we trust this update will provide you with key information to navigate the dynamic landscape of the lumber market. Feel free to reach out if you have any questions or would like to discuss how these insights can be tailored to your specific needs. Thank you for your continued partnership, and here’s to a successful 2024 and and beyond!

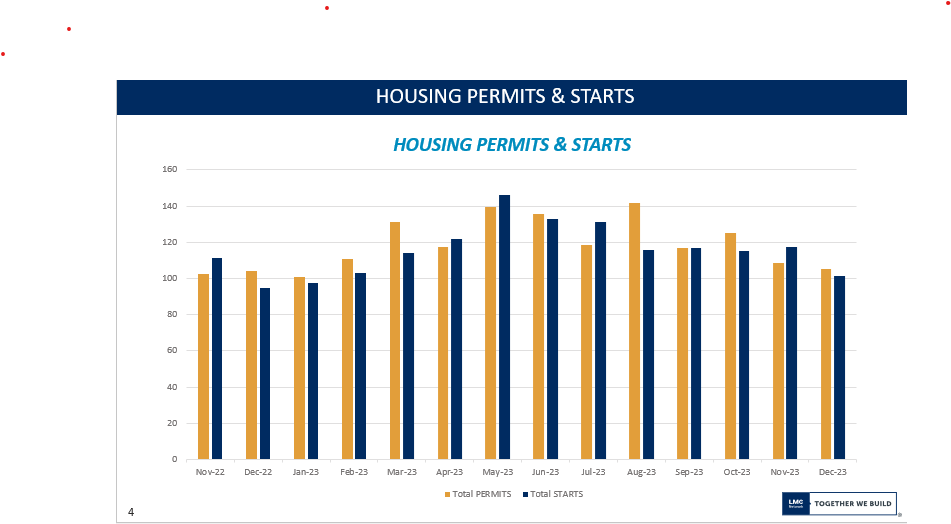

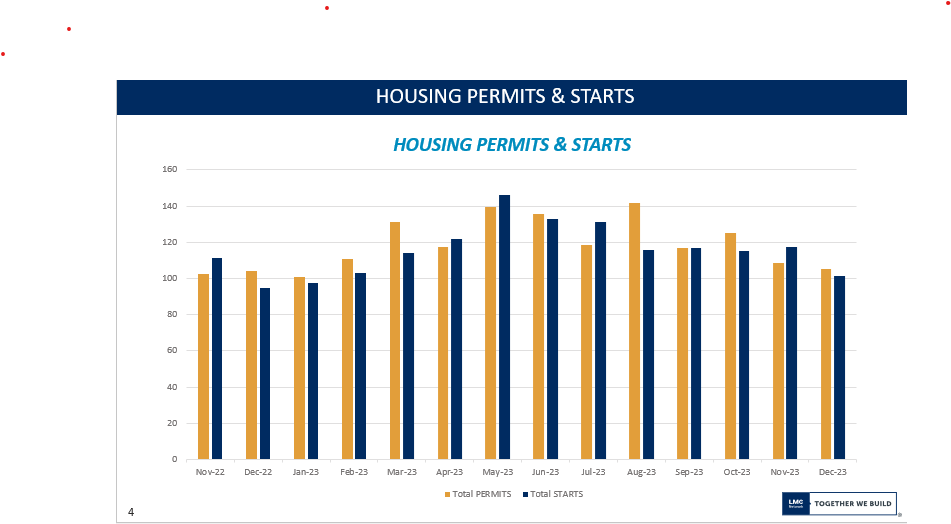

ANNUAL HOUSING STARTS AND PERMITS

Building Permits Privately‐owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,495,000. This is 1.9 percent above the revised November rate of 1,467,000 and is 6.1 percent above the December 2022 rate of 1,409,000. Single‐family authorizations in December were at a rate of 994,000; this is 1.7 percent above the revised November figure of 977,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in December.

An estimated 1,469,800 housing units were authorized by building permits in 2023. This is 11.7 percent below the 2022 figure of 1,665,100.

Housing Starts Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,460,000. This is 4.3 percent (±12.5 percent) below the revised November estimate of 1,525,000 but is 7.6 percent (±17.6 percent) above the December 2022 rate of 1,357,000. Single‐family housing starts in December were at a rate of 1,027,000; this is 8.6 percent (±11.2 percent) below the revised November figure of 1,124,000. The December rate for units in buildings with five units or more was 417,000.

An estimated 1,413,100 housing units were started in 2023. This is 9.0 percent (±2.5 percent) below the 2022 figure of 1,552,600.

LUMBER

We saw extensive lumber curtailment in 2023 throughout North America, including the permanent closure of three sawmills, and the anticipation is for that trend to continue into the half of 2024.

Mills in Western Canada and the Pacific Northwest are struggling to produce profitably in the face of extremely high fiber costs relative to current lumber pricing.

Total North American Production

2020 – 60.521 billion board feet

2021 – 60.580 billion board feet

2022 – 58.909 billion board feet

2023 – 57.669 billion board feet

The price forecast for the beginning of 2024 should look very similar to the pricing we saw throughout 2023, trading in a relatively narrow range.

The 2023 Framing Composite traded in a $101 range, with a low of $367 mbf and a high of $468 mbf. Forecasts are for continued heavy curtailment out of Western Canada being offset by additional production coming online out of the U.S. South. Housing was resilient throughout 2023 and anticipation for 2024 is that it should remain that way, especially with anticipated rate cuts from the Fed in the second half of 2024.

- West Fraser announced the completion of their purchase of the Spray Lake Sawmill located in Cochrane, Alberta. The mill has an annual lumber capacity of 155 million board feet.

- Sun Mountain Lumber announce the purchase and re-opening of the Livingston, MT, sawmill that was formerly owned by R-Y Timber.

- VIDA AB, owned 70% by Canfor Corporation announced that it will invest approximately 700 million SEK (CAD$85 million) at its Bruza Sawmill in Hjältevad, Sweden, expanding production from 175 million board feet to 240 million board feet. This major investment includes a new high-capacity planing mill equipped with the latest technology, a new boiler, wood drying kilns and warehouse.

- Canfor has announced a 6-month closure of their Polar mill, which is located north of Prince George, British Columbia, “due to a shortage of economically available fibre in the region.” This reduction in capacity will take approximately 140 million board feet of lumber out of the market as well as impacting the jobs of 190 employees. The shutdown is anticipated to start in January as Canfor works through their existing log inventory.

- Hampton Lumber announced that their sawmill in Banks, OR, that has been closed since October will now be shuttered indefinitely.

PLYWOOD AND OSB

The plywood market started off Q1 at a strong pace as mild and dry weather has helped to keep the PO books out and construction moving along nicely. If the weather remains decent, expect sales to be very steady throughout the quarter.

Pricing continues to be stable most across both species and dealers are keeping their 30–45-day needs covered, while remaining cautious beyond that. Some buyers are waiting for pricing to come off before stepping back into the market, but that is not going to happen as long as mills sustain a 2–3-week order file.

Seemingly, OSB producers got it right for once, dialing in production output with demand. This results in the market we’re currently enjoying with stable prices. Interestingly, cash market offers from the mills remain few and far between.

Most OSB currently finds its way to market via contracts from distributors, wholesaler and buying groups like LMC. Lead times on shipment from the mills ranges from late February through March. Getting caught short of product now would not be advisable.

It will not take much to tip this precarious price stability in either direction. The current cold-snap gripping the country, for instance, could slow consumption, allowing prices to slip. Should this happen, the downturn would likely not last long.

Little on the horizon suggests production capacity to increase in the next 90-120 days, so the more likely scenario would have prices tilted up moving into the busier Spring months when job site activity normally picks up.

Stay tuned for more Fourth Quarter Lumber Industry Updates!