Lumber Market Movement

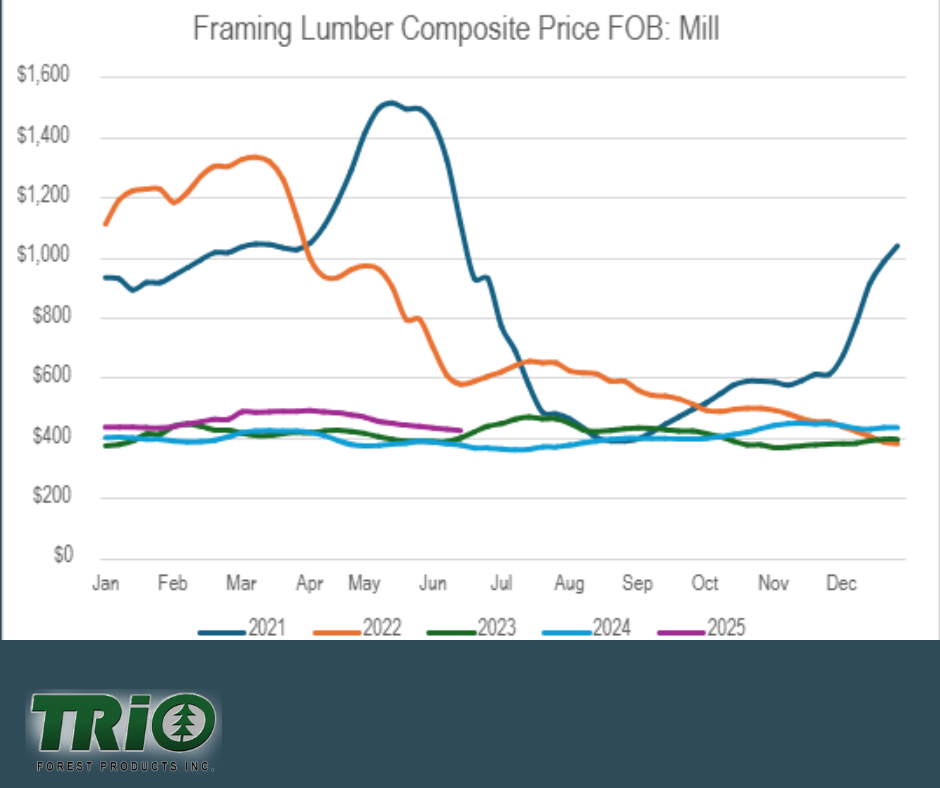

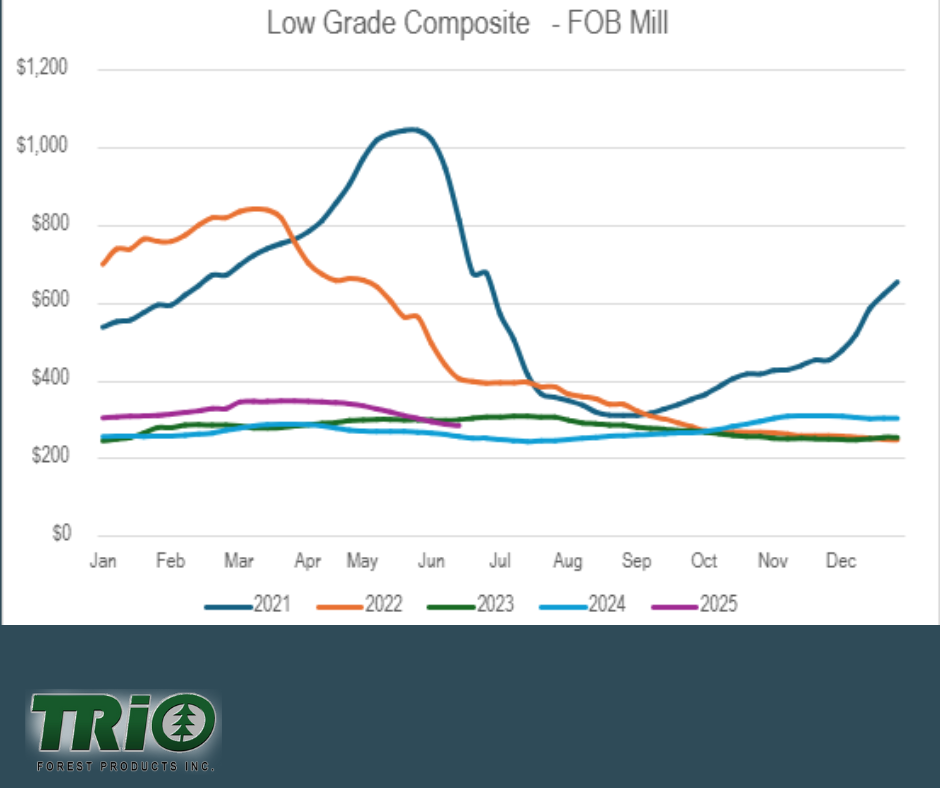

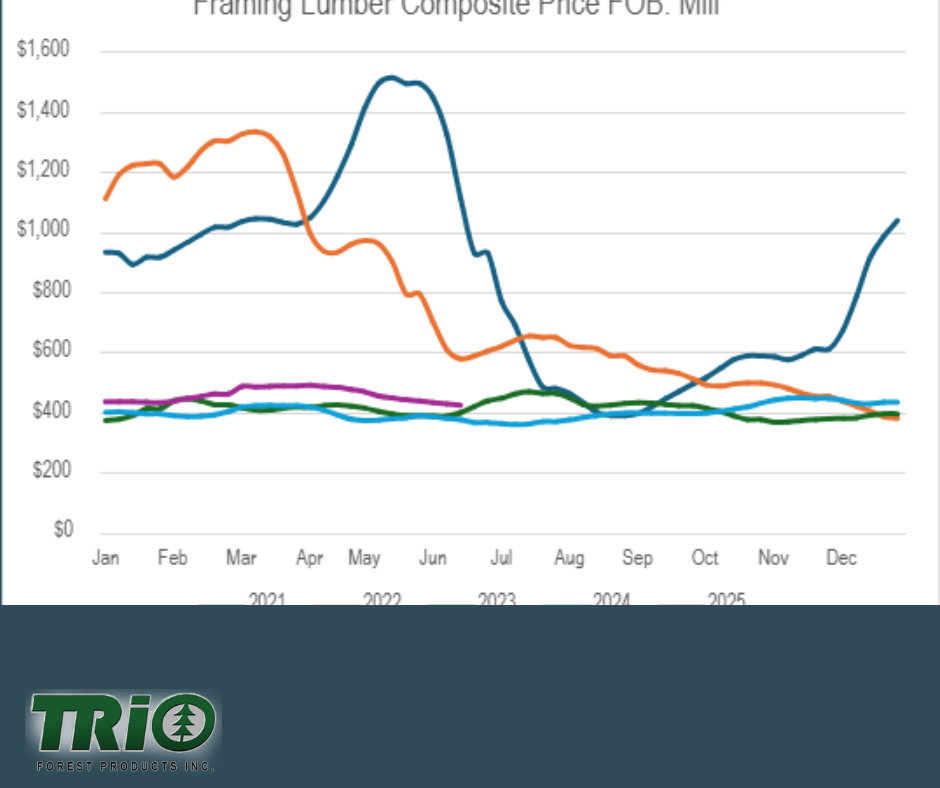

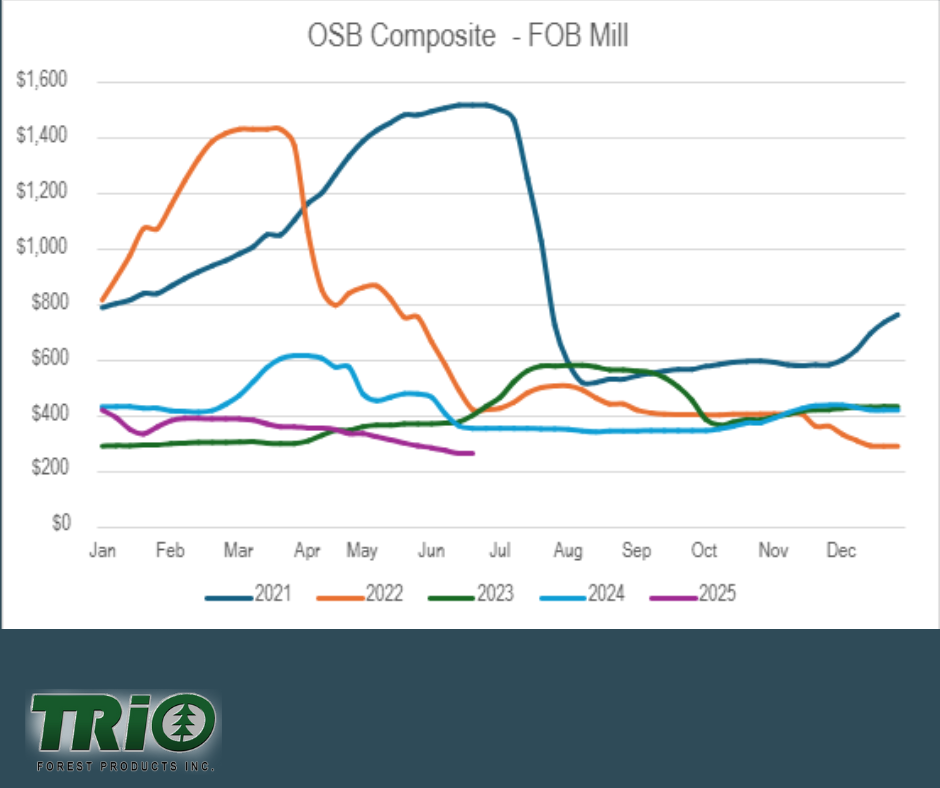

As we roll into July, the composite graphs across framing lumber, low grade, OSB, and structural panels show prices finding a bottom and bouncing — a quiet moment that deserves a watchful eye.

But bigger waves are on the horizon.

We’re nearing the final ruling on the AR6 trade case. Low current demand is expected to lead to supply disruptions when activity picks up, due to factors like AR6 duties (AD & CVD), wildfire impacts, limited log availability, and production curtailments.

According to sources, the AD (anti-dumping) ruling will be finalized as soon as 7/24/25 and take effect around 7/28/25, pending no further extensions. The CVD (countervailing duty) ruling will follow as soon as August.

Price Impact:

- Expect an average 13% increase from the AD ruling

- Followed by an average 8% increase from the CVD ruling

- Although these apply to Canadian mills, U.S. mills will likely raise prices too

Recommendation:

If you need material and have the cash flow, it may be wise to buy now and avoid the expected price hikes.

Staying informed, staying adaptable, and leaning into strong partnerships — that’s how Trio helps customers weather what’s ahead with confidence and keep the American spirit of resilience alive.

Historically, we know the market will reignite. Maybe not with the thunder of a grand finale, but more like the steady shimmer of a sparkler lighting the way forward.

|