Looking Ahead to 2026

What Will Shape the Lumber Market Next

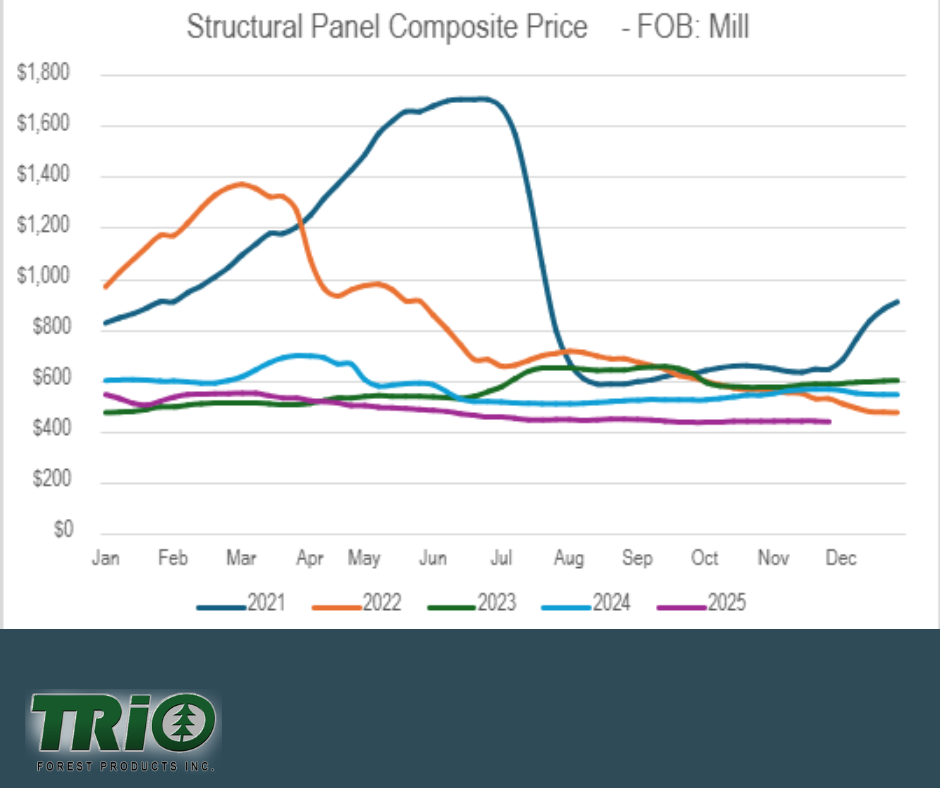

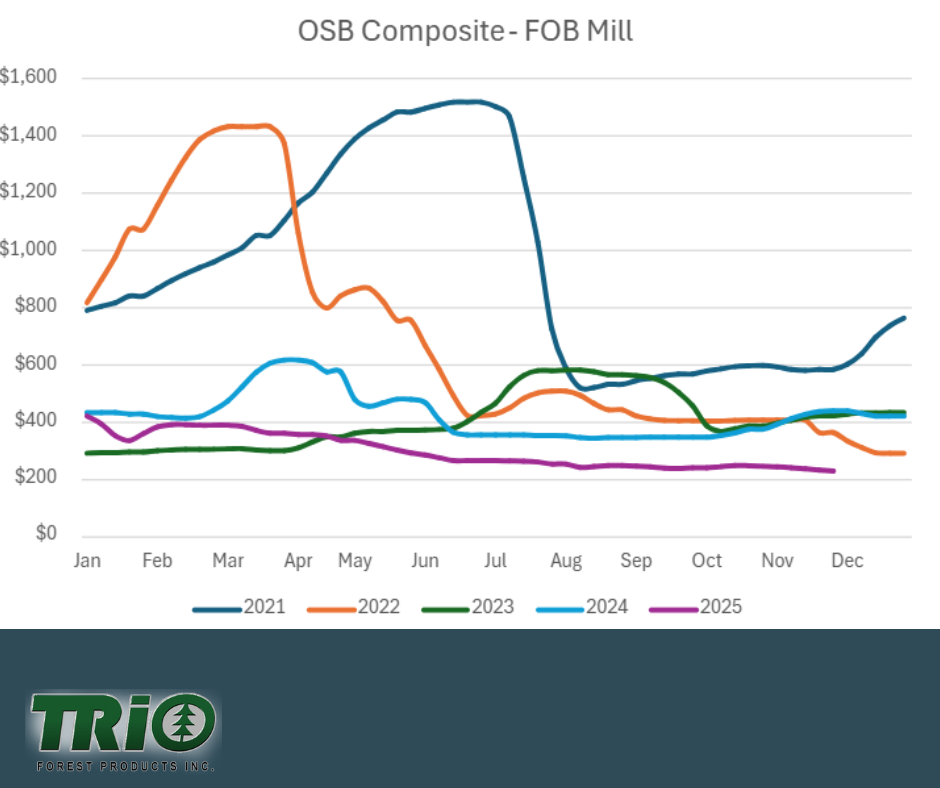

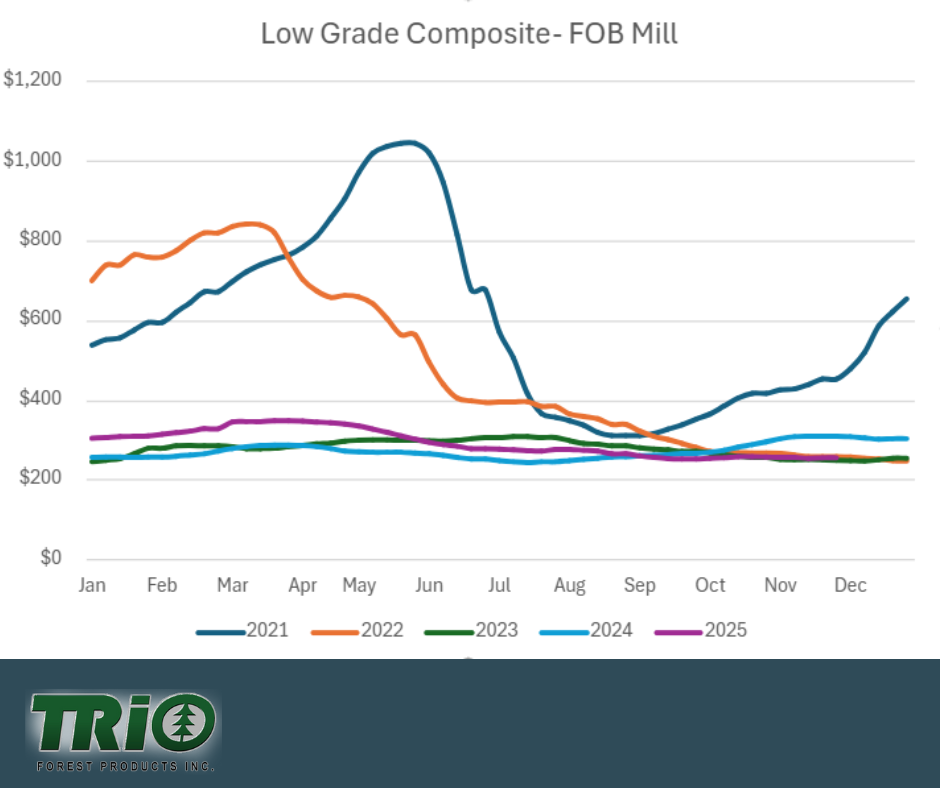

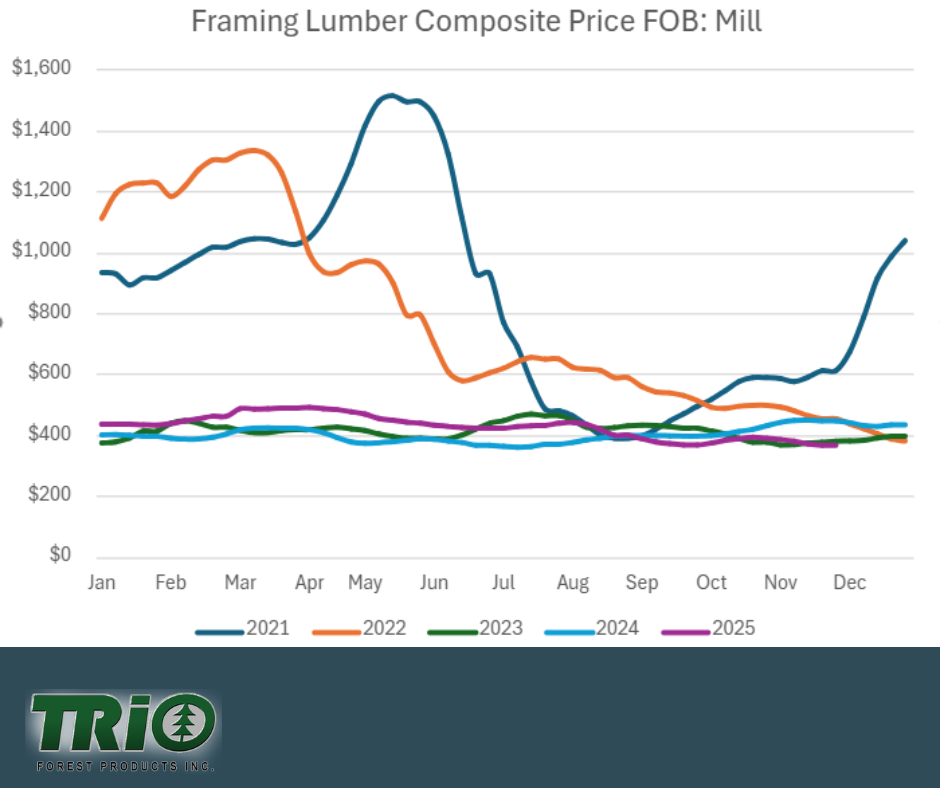

As we prepare to enter 2026, the lumber market is transitioning into a new chapter—one that looks very different from both the volatility of the COVID years and the quiet normalization of 2023–2025.

The National Association of Home Builders (NAHB) continues to report steady but measured demand for new housing, and the indicators we track beyond permits and housing starts tell us that the coming year may be shaped by forces that often sit behind the headlines but have major real-world effects on lumber pricing and availability.

Below are the key drivers we’re watching as 2026 approaches—each one a pressure point in the broader supply-and-demand ecosystem.

Housing Demand: Not Just Starts, But Who’s Buying

While permits and new home starts remain the backbone of lumber forecasting, NAHB has highlighted several emerging demographic forces:

- Millennials aging into peak homebuying years – The average age to buy a home is now 40.

- Gen Z entering the market earlier than expected

- Boomers downsizing but still competing for inventory. Average age of a Seller is now 64 and they want to help their children and grandchildren buy a home.

Combine these with ongoing nationwide undersupply, and 2026 is shaping up to be a year where demand will remain stable—even if interest rates don’t fall dramatically.

For Trio customers, this means builders are likely to stay active, and framing packages should continue to move predictably.

Labor Availability at the Mills

One of the biggest—but quietest—drivers of lumber price stability is mill labor. Even in 2025, several regions continue to struggle with:

- Skilled labor shortages

- Aging workforces

- Higher recruitment and retention costs

- Mill curtailments and shutdowns result in layoffs

NAHB labor analytics suggest that production capacity may tighten slightly in early 2026, not because demand is skyrocketing, but because mills are running lean.

This isn’t expected to create shortages, but it may contribute to firmer pricing, especially on certain commodity items.

Our job in the middle is to balance both sides: honoring mill partnerships while protecting our customers from volatility. It isn’t easy — but it’s the role Trio was built for.

Repair & Remodel (R&R) Market Strength

A major talking point from NAHB and multiple national economic groups: The renovation market may outpace new construction growth in 2026.

Why?

- Aging housing stock

- Homeowners upgrading instead of selling – Homeowners now stay in their homes an average of 11 years.

- Energy-efficiency incentives

- Multigenerational living increases – HUGE concept in todays real estate market.

This matters because OSB, panels, and low-grade products move heavily through the R&R channel.

In other words: Even if new-build permits flatten, demand won’t.

|

|

|

Weather

Weather Patterns: El Niño, La Niña & Fire Seasons

Weather has always been a character in the lumber story, and 2026 looks to be no exception.

Climate data shows increasing unpredictability in:

- Fire season severity in the West

- Storm impacts in the Southeast

- Freeze/thaw cycles in the North

Each of these affects logging, transportation, and mill uptime. A harsh fire season, for example, can choke supply quickly—not through demand, but through access restrictions.

It’s not dramatic to say that weather remains one of the fastest-moving variables in the entire lumber market.

|

Washington

Washington, D.C. — Policy, Tariffs & the 2026 Election Cycle

Politics may not build homes, but it absolutely influences what goes into them. As 2026 approaches, we’re monitoring:

- Softwood lumber tariff discussions with Canada

- Infrastructure spending bills affecting construction material demand

- Environmental policy changes tied to logging access

- The early impact of the 2026 election cycle on economic confidence

Historically, uncertainty in Washington tends to slow buyer sentiment temporarily, while finalized policy often reignites movement.

Either way, politics continues to play a subtle but important role in lumber pricing momentum.

|

Wild Card

Trucking, Rail & Logistics

COVID exposed just how fragile our transportation infrastructure can be. While 2024 and 2025 have been calmer, several factors could influence 2026:

- Ongoing rail union negotiations

- A shortage of long-haul drivers

- Fuel price variability

- Port congestion cycles

A single disruption—a rail slowdown, a port delay, or a fuel spike—can ripple into mill-to-yard movement for weeks.

Trio has always been proactive in anticipating and adapting to these shifts, helping customers feel the effect as lightly as possible.

|

Builder Confidence & Material Planning Behavior

Perhaps the most human—and most influential—factor shaping the market.

Builder confidence is rising slowly and steadily according to NAHB sentiment surveys. Builders and our customers today aren’t overbuying, but they’re also not sitting still.

They’re planning smarter. Ordering tighter. Managing project timelines with precision.

This leads to a healthier, more stable market overall—one that rewards consistency, communication, and partnership.

Exactly what Trio has always stood for.

Navigating the Lumber Market with Experts

We hope you enjoyed and feel informed on current market trends.

However, nothing beats real time expert guidance!

Stay in front of lumber market fluctuations and insights by working with Trio.

Join us as we track price changes and market trends in real time.

Reach out to our team of experts for your purchasing strategy – The Trio Team